The Myth of Millionaires

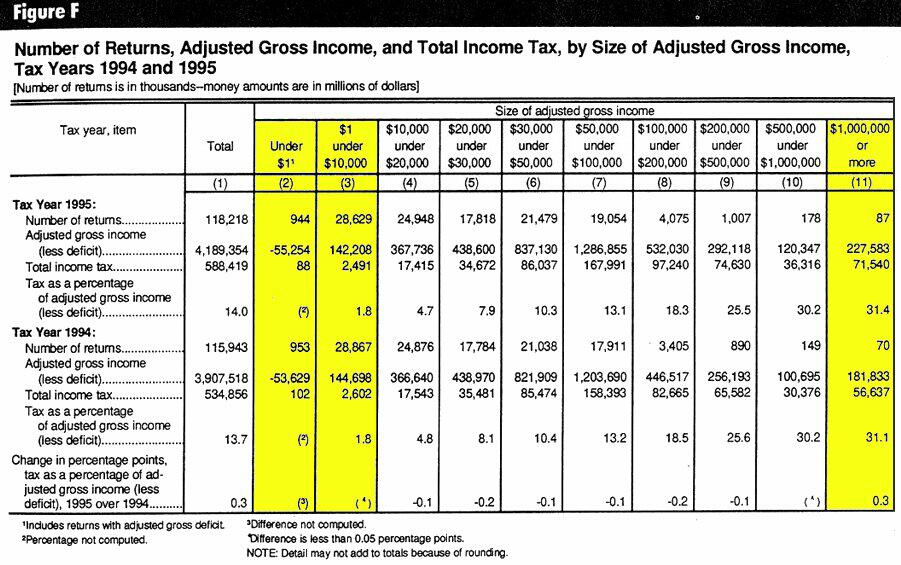

The aim of the information contained within this page is to clear up some of misconceptions about how many millionaires there are in the United States. This table was taken from Statistics of Income Bulletin or as it is better known SOI Bulletin, Volume 17, Number 2, Publication 1136, Fall of 19997. It was produced by the Department of the Treasury, Internal Revenue Service.

This report fails to show, or any other report from the US federal government concerning millionaires, the following:

- The percentage of those millionaires who inherited or immigrated to this country with their money.

- The number of millionaires who have renounced their US citizenship to avoid paying US income and inheritance taxes. These 'un-American' millionaires become citizens of a country who has little or no income tax, such as Belize. FMI see the case of Kenneth Dart, the foam cup billionaire, owner of the Dart Container Corporation.

- The number of individuals that filed a US federal tax return between zero and $10,000 who were or who still are in charge of companies that gross more then a million dollars a year. The reason an individual, running a million dollar gross company, would only pay themselves less than $10,000 (sometimes just a single dollar) is to avoid paying personal income tax.

Revised on July 31, 2000.