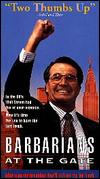

From the Movie "Barbarians at the Gate"

|

Film Statistics

|

|

"Barbarians at the Gate, a made-for-HBO movie, recounts the events surrounding the biggest leveraged buyout in history, that of RJR Nabisco in 1988. Based on the bestseller of the same name, this film presents in some detail the process by which RJR Nabisco's CEO F. Ross Johnson (James Garner) attempts to buy out his own company. Of greater interest, however, is the power struggle that develops between Johnson and Wall Street investment banker Henry Kravis (Jonathan Pryce), who intends to force Johnson out and take over RJR Nabisco on his own.

In general, the quality of most made-for-TV movies is abysmal. Low production values, shoddy direction, and poor acting abound. There are exceptions, of course, but not many. For that reason, in a year when there have been three too many Amy Fisher movies on the small screen, it's refreshing to come upon something with the intelligence, wit, and general high quality of Barbarians at the Gate.

This story of high stakes, betrayal, and one-upsmanship is told with undeniable flair, using a lighthearted, occasionally playful, tone. The film offers a different point-of-view on leveraged buyouts and other such mega-buck dealings. Most of us are used to looking in from the outside on these high-profile financial struggles; Barbarians at the Gate presents an insider's perspective -- and not just any insider, but that of the man at the top.

It's a credit to the production team that they're able to do so much with this movie. There's a lot of dry humor, a fair amount of tension, and numerous subtle-yet-pointed jabs at a "game" that rewards the losers with $23 million (after taxes). Pacing is excellent, especially during the last half-hour as the story builds to its climax. The furious rushing around of the characters is effectively translated to the audience. Whether you know the outcome or not, Barbarians at the Gate is captivating.

One would think that it would be difficult, if not impossible, to present a story with someone like F. Ross Johnson as the protagonist. After all, this is a very rich man involved in the kind of financial slight-of-hand that most Americans despise. However, screenwriter Larry Gelbart (taking cues from the Burrough/Helyar book) has managed to make Johnson a sympathetic and often-likable figure. Admittedly, the movie takes liberties. Some of Johnson's less-admirable traits have been downplayed, and he's presented as caring more about the work and the people who do it than the money he stands to make.

If this isn't the best performance of James Garner's career, it certainly tops his recent credits. It's difficult to gauge how much of the audience's rapport with Johnson comes as a result of the actor playing the role, but the job done by Garner is no small factor. His portrayal perfectly mixes greed, humanity, good-naturedness, and incompetence. As Henry Kravis, Jonathan Pryce is equally as good, albeit with less screen time. Pryce makes the most of his opportunities and, although the Kravis is presented as a two-dimensional villain, Pryce's steely-eyed, tight-lipped performance gives the audience a good sense that this man should be feared.

These strong performances, coupled with a lively, clever script, are enough to draw the audience into the world of F. Ross Johnson.

His morals, like those of anyone in a situation where a million dollars is small change, are twisted, and the film delights in showing this in several wickedly-funny scenes.

Nevertheless, the presentation of how he manages -- and sometimes mismanages -- the buyout is fascinating. Even more engaging is the battle between Johnson and Kravis, which has all the drama of a high-stakes chess match.

So, as much as the average person despises financial fakery that results in thousands of lost jobs, Barbarians at the Gate, by looking at the situation from a different perspective, turns this matter into thought-provoking entertainment."

A review by James Berardinelli writen in 1993 (recorded here just in case it gets lost)

The Aftermath of the buyout (February 9, 1989): $18.9 billion. Drexel Burnham Lambert provided a $5 billion bridge loan, KKR transferred $2 billion, and Manufacturers Hanover Trust Co. arranged a global syndicate for $11.9 billion.

What the losers got:

Ross Johnson received $53 million.

Ed Horrigan $45.7 million.

John Martin $18.2 million.

The Fees -

Drexel Burnham Lambert - $227 million plus undisclosed fees from issuing the junk bonds.

Merrill Lynch - $109 million.

Kohlberg Kravis Roberts (KKR)- $75 million from its investors.

Morgan Stanley - $ 25 million.

Wasserstein, Perella - $ 25 million.

Bank syndicate of 200 institutions - $325 million.

The following are some highlights from the film...

LAURIE: Ross? Promise you won't think I'm stupid?

ROSS: Of course, not.

Although, I have been known to break my promises.

LAURIE: There's so much of this I just don't get.

Insider trading. Junk bonds.

Even this buy out thing you're talking about.

ROSS: Sweetheart, half the people involved don't know what's going on.

Buy outs are not all that hard, really. . . .

Basically, all a buy out means is that management -- the team that runs the company --

they buy out all the shareholders, and the company goes from being public to being private.

LAURIE: Doesn't that take a ton of money?

ROSS: That's where the Kravis types come in.

They help you borrow what you need against the value of the company.

You use the business as collateral.

In this scean Ross Johnson is to meet his very wealthy adversary, Henry Kravis, the king of leveraged buyouts

KELLY: Ross.

BUTLER: Will you have a drink, sir?

ROSS: Scotch and soda. No ice. No soda.

BUTLER: Thank you, sir.

(Ross looks around the opulent apartment and is clearly dazzled.)

KELLY: Be it ever so humble, huh?

ROSS: Guy must've had a hell of a week. (As Ross inspects a painting.)

KELLY: Renoir.

ROSS: Ball park?

KELLY: Twenty, thirty million.

ROSS: Is that with the frame?

(He moves to the next painting, looks for the signature.)

KELLY: Monet.

ROSS: Right. Tons of it.

(Henry Kravis appears quietly, trying to exuding his unmistakable authority.)

ROSS: Listen, Henry, if there's anything you need--if you're hurting in any way--all you have to do is ask.

ROSS: We've spent seven hundred and fifty million dollars and we've come up with a turd with tip?

God, almighty, Ed.

We poured enough technology into this project to send a cigarette to the moon,

and all we got out of it is one that tastes like it took a dump. . . .

Tastes like shit and smells like a fart.

We got ourselves a real winner here.

It's one Goddamn unique advertising slogan, I'll give you that. . . .

How do we get it shitless?

To learn more about KKR and Henry Kravis, follow this link. Be forewarned, its freighting.